About Gold

Throughout history, gold has played a vital role in shaping society, economy and industry. Even after the gold standard was abolished in 1971, gold continued to appreciate in the open market and increased in price far beyond its industrial value. Despite gold no longer having a role in monetary policy, central banks, commeFFrcial banks and governments continue to hoard the precious metal. Gold is used for producing jewellery, dentistry, manufacturing components for the technology industry, and investing.

The average investor likely purchases gold bullion coins or ingots from a local mint or dealer. Institutional investors likely go to a large exchange, such as the London Metal Exchange or the Chicago Mercantile Exchange. Trader’s looking to speculate on gold price over a short to medium timeframe may use CFDs.

Important Gold Discoveries

1718 - Ouro Preto, Brazil

Gold was discovered in the Portuguese colony of Brazil, which became the largest producer of gold by 1720, with nearly two-thirds of the world’s output. 800 metric tons of gold were sent to Portugal.

1799 - North Carolina, United States

A 17-pound gold nugget of gold is discovered in Cabarrus County, North Carolina. It was the first documented gold discovery in the United States and sparked the first US gold rush.

1848 - California, United States

Someone accidentally found gold flakes in Sacramento California while building a sawmill. Word soon travelled, and approximately 300,000 people migrated to California.

1850 - New South Wales, Australia

Edward Hargraves, a British sailor, travelled to California to participate in the California gold rush but missed out. He took his knowledge to Australia, where he discovered gold in New South Wales within one week of arriving.

1886 - Johannesburg, South Africa

George Harrison, while digging up stones to build a house, discovers gold in South Africa. Since then, the country has been the source of almost 40% of all gold ever mined.

1898 - Alaska, United States

Two gold prospectors discovered gold while fishing in Klondike, Alaska, spawning the century’s last gold rush.

* Risk Warning: Trading in forex and CFDs could lead to a loss of your invested capital.

Why trade Gold CFDs?

* Risk Warning: Trading in forex and CFDs could lead to a loss of your invested capital.

XAU/USD CFD Specifications

The symbol for gold in the forex market is XAU. In other markets, it might be known under different symbols, such as GC. At Trade Markets, we offer gold quoted against the US dollar. When you trade XAU/USD, the base asset is Gold, and the quote asset is US dollars. The standard contract size, often referred to as the Lot size is one-hundred troy ounces. Unlike a conventional ounce, which is 28 grams, a troy ounce is 31.1 grams. The smallest order size you can enter is 0.01 Lots, which is equal to one troy ounce.

XAU/USD is quoted with two decimal places. The second digit is known as the Pip. The value of a Pip depends on the size of the contract. If you open a position for 1 Lot of XAU/USD, the Pip value will be $10, whereas if you open a position for 0.01 Lots of XAU/USD, the Pip value would only be $0.10.

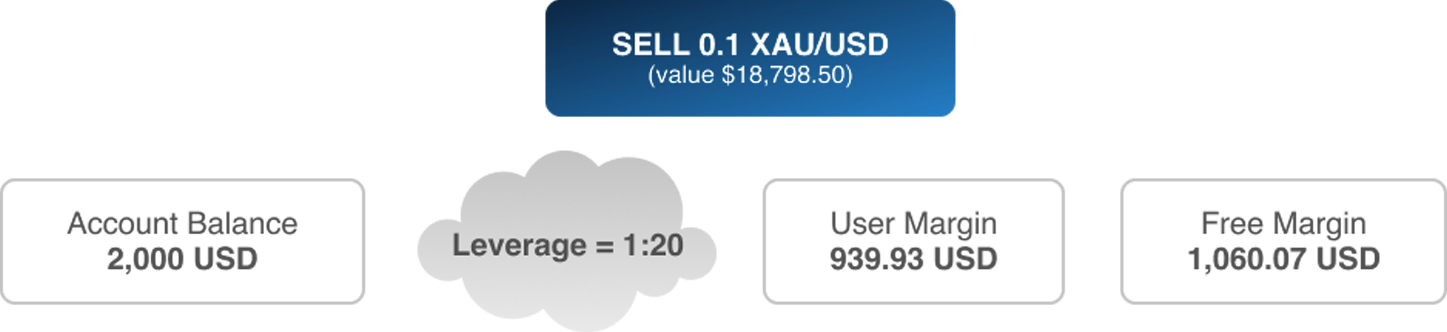

One of the benefits of CFD trading is you can use leverage to reduce how much capital required to open positions. Trade Markets offers up to 1:20 leverage for trading XAU/USD, which means you only need to provide a 5% margin to open a position.

Leverage can be a useful tool when applied strategically. If you don’t take the proper cautions when trading with leverage, it can lead to greater losses.

How A CFD Transaction Works

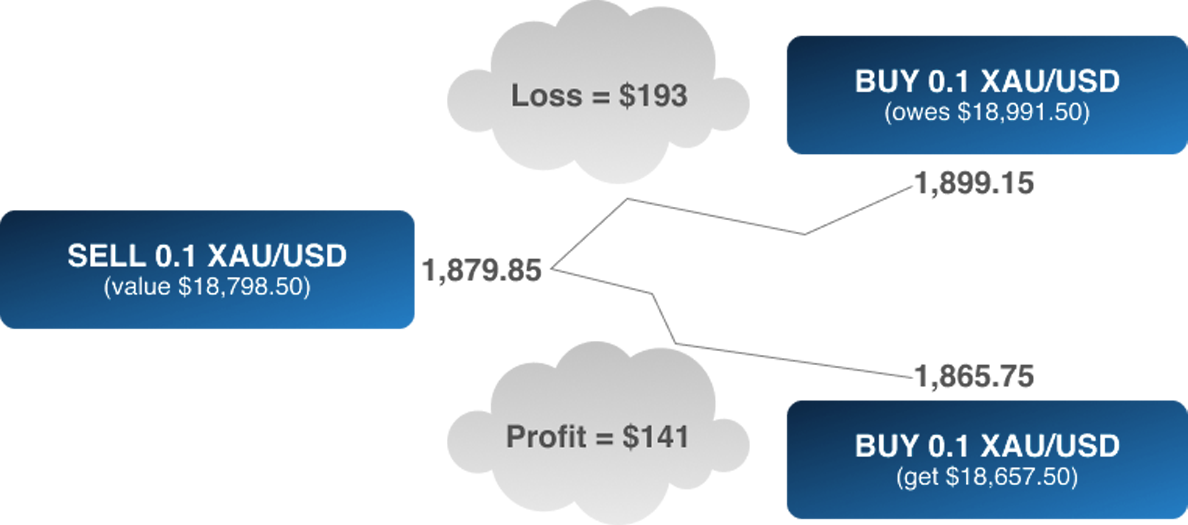

When you go short on XAU/USD, you’re theoretically selling gold for dollars. To close the position, another trade in the opposite direction is used to offset it. Your profit or loss will be calculated in dollars. If the price of gold decreases, you profit and are left with more dollars when you close the position. If gold strengthened, you’d get back fewer dollars.

With leverage, you can open larger positions than your capital would otherwise permit. When you trade CFDs with Trade Markets, you can use leverage as high as 1:20; meaning you only need to provide margin to cover 5% of the position’s value.

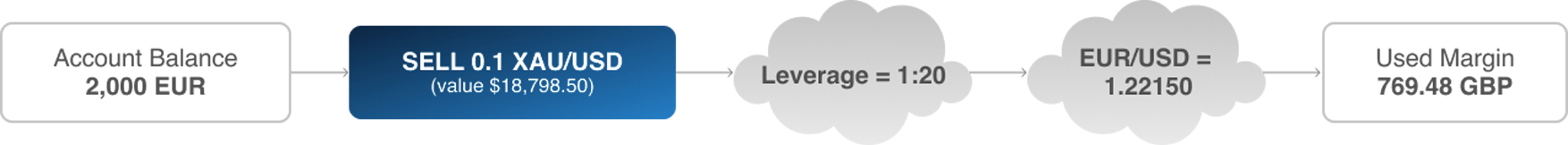

When you trade CFDs, you don’t need to own either of the assets or currencies involved in the trade. For example, if your trading account balance is funded with euros, you can still trade XAU/USD. The purpose of a CFD is to allow traders to speculate on an asset’s price without having to purchase it or own it. When a CFD is closed, it will always be settled in cash either by increasing or decreasing your trading balance.

Costs to trade XAU/USD

There are different costs associated with trading CFDs with Trade Markets. There are three primary factors which influence how much it costs to trade CFDs; they are:

The size of your trade, the bigger the trade, the higher the fees.

The instrument you’re trading, as different products have different characteristics.

The type of account you have, as different accounts have different conditions.